Businesses structured as a single trading company are common-place but often undesirable from a risk perspective. Where that single company operates the trading business and also owns valuable assets such as property, plant, equipment and/or intellectual property rights, should the trading business fail then the valuable business assets would almost certainly be at threat (i.e. available to creditors).

As COVID-19 and the resulting lockdown measures have for many brought about a very real and increased threat of business failure, businesses should be considering risk mitigation strategies, especially single trading companies.

Further reading: A Simple Reorganisation To Protect Valuable Company Assets From Trading Risk

Case study

After a number of years working together, Tom and Harry went into business together in 1995 manufacturing parts for the agricultural machinery and aerospace industry. Following advice from their accountant and legal advisers, Tom and Harry set up T&H Parts Limited as 50/50 shareholders with both of them as directors.

Like many start-ups, funds were tight in the early days. T&H Parts Limited leased a very old unit from which it ran its operations and had limited plant and machinery, most of which was purchased second-hand.

As is the case for many start-up businesses, the first few years were tough and T&H Parts Limited only just made a profit. However, after 5 years of trading T&H Parts Limited began to win significant contracts and see year-on-year increases in turnover and profits. During this time of growth, T&H Parts Limited invested heavily in purchasing cutting-edge plant and machinery to fulfil its ever-growing number of contracts and took a lease of the neighbouring unit when it became available.

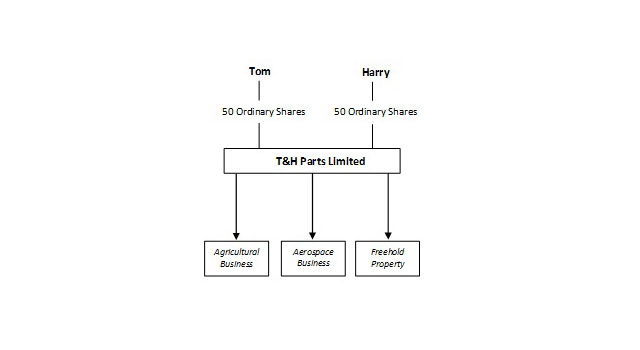

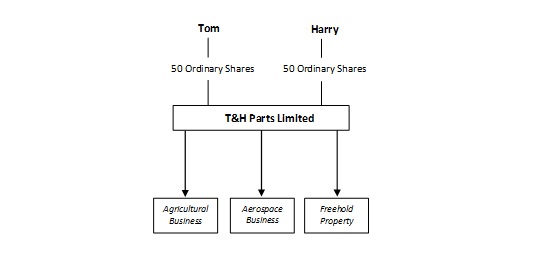

As the growth continued with the number of contracts, T&H Parts Limited quickly outgrew its leased premises. After a number of years of retaining profits in the business, in 2010 T&H Parts Limited purchased a purpose-built facility in a popular location close to its main customers. Today the property is worth £1m and the company structure is as follows: As a result of the COVID-19 restrictions, the agricultural side of the business has flourished but the aerospace side has taken a downturn with orders drying up and some being cancelled or delayed.

As a result of the COVID-19 restrictions, the agricultural side of the business has flourished but the aerospace side has taken a downturn with orders drying up and some being cancelled or delayed.

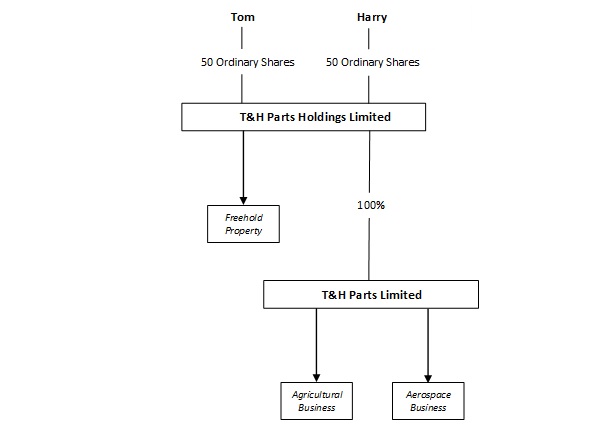

Tom and Harry therefore decided to reorganise the structure of their business to separate the freehold property from the trading business. Following tax, accountancy and legal advice, Tom and Harry undertook a reorganisation whereby:

- Each of them transferred their shares in T&H Parts Limited in return for an equal number of shares issued by a newly incorporated company, T&H Parts Holdings Limited.

- T&H Parts Limited transferred the property to T&H Parts Holdings Limited by way of a distribution in specie.

The resulting structure was as follows:

As can be seen from the resulting structure, the property is now ringfenced from the risk of the trading business. Should T&H Parts Limited suffer an insolvency event then the freehold property no longer forms part of its assets and therefore shouldn’t be available to creditors on a winding up.

Furthermore, the structure creates a platform for further reorganisations (for instance, it provides the option for a demerger to separate the agricultural and aerospace division to further ring-fence risk). To mitigate risk further, T&H Parts Limited could also transfer its plant and machinery to T&H Parts Holdings Limited.

BHW regularly advises on, and implements, a variety of corporate reorganisations (including demergers). If you would like to discuss a potential reorganisation further then please contact Alex Clifton on 0116 281 6232 or email alex.clifton@bhwsolicitors.com.

This case study is intended to be an illustrative example only and any similarities to real people and/or companies is entirely coincidental. Furthermore, proper tax, accountancy and legal advice should always be sought before implementing any such reorganisation, not least to ensure that it provides the expected benefits and doesn’t create any unintended or undesirable tax consequences.

Categorised in: Aerospace, Agriculture, Corporate and Commercial, Covid-19, News

Tags: Business Restructure, Coronavirus, Reorganisation